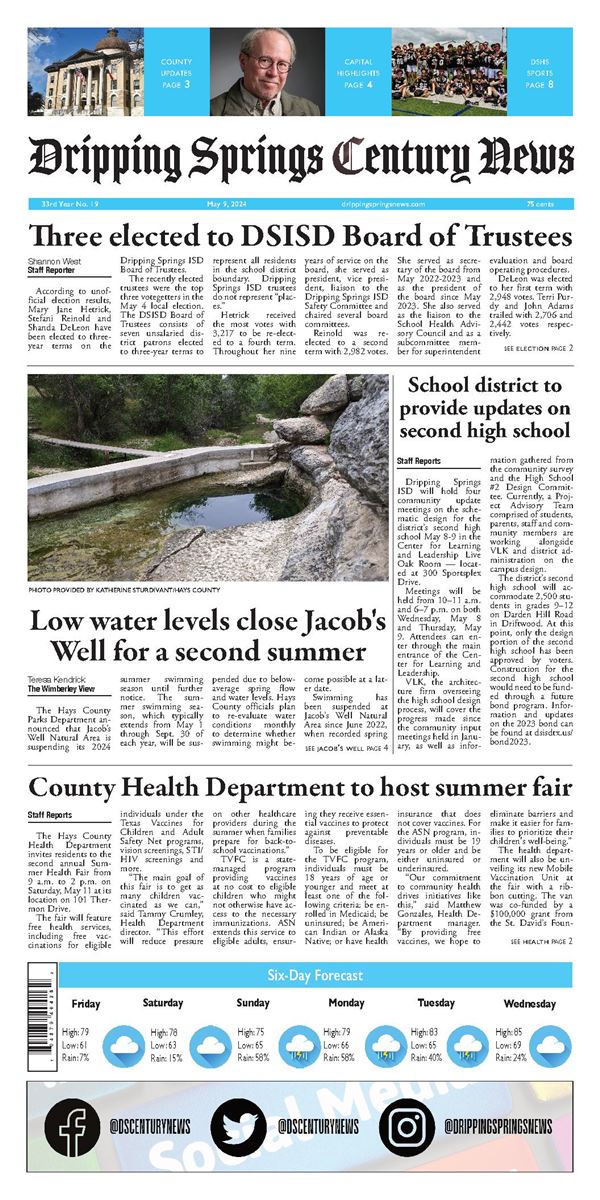

The Dripping Springs Board of Trustees met on Sept. 22. The Learning Spotlight for the month was from Sycamore Springs Middle School, and the Peer-Assisted Leadership (PALs) program. Student leaders attended and spoke to the board about their program.

Afterwards, the board heard public comments. A group of DSISD paraprofessionals stood to address the board. Their spokesperson was LaDelle Gowens, a special education instructional aide at the high school. She said the group has come before the board on multiple occasions over the past several years to address the issue of pay for paraprofessionals, and so far, they have not gotten the results they have been seeking.

“So what’s the defini- tion of a successful employee? It includes but is not limited to, strong work ethic, positive workplace behavior, willingness to learn, teamwork…” Gowens said. “As an adult, our paycheck is our report card. And even when we’re hitting and exceeding all the benchmarks of the successful employee, we receive failing grades from our pay.”

She said a lot of the paraprofessionals working for the district cannot afford to live in the area. Many work second jobs, and some have even had to quit to find other employment.

Gowens invited the board members to come and visit the paraprofessionals on the job.

“Put us first on your list,” Gowens said. “Come see us and what we do every day with our most vulnerable population and our special needs kids.”

In other business, the Board ofTrustees unanimously approved the 2025 tax rate of $1.1052 (per $100 of certified property value). That rate is unchanged from 2024 and has decreased by more than 41 cents since 2018, according to the district. Due to the anticipated increase in the homestead exemption on the November ballot, the average DSISD homeowner is expected to pay approximately $6,847 in property taxes - down from $7,206 last year.

The total tax rate of $1.1052 consists of two parts: $0.7552 for Maintenance and Operations and $0.35 for Interest and Sinking. The Maintenance and Operations (M&O) portion covers district operating costs, such as salaries and benefits, utility bills, and supplies, and is subject to recapture. The Interest and Sinking (I&S) rate generates revenue that can only be used to pay off voter-approved debt.

Property tax bills are a product of the tax rate and the property value. Therefore, a property owners’ tax bill could increase even when the tax rate remains the same or decreases.

The next meeting of the DSISD Board of Trustees is set for Oct. 27.

Members of the Peer-Assisted Leadership (PALs) group from Sycamore Springs Middle School attend the board meeting. PHOTO BY LAURIE ANDERSON

.png)